YESTERDAY RECAP:

Well, I mentioned in yesterday’s newsletter that while I was impressed with what the Bulls did Thursday and especially Friday, I was on high alert for what I like to call a “gap and crap”. Basically I was worried that a close like we saw on Friday had high odds of opening strong, then repairing all the poor structure we left behind. And that is basically what happened. We had a pretty strong Sunday right into Resistance, small dip, bounce back into resistance again, then a larger dip into Support, followed by a third bounce that ultimately got sold the rest of the day. Our levels held up pretty well the entire session but the “cash” session was kind of tame and lower volume than we are used to with all the action happening in a small $1.25 range. Not the best trading conditions for me personally but if you were fast with scalping you could’ve probably done pretty well today.

TRADE RECAP:

No trades for me personally today as the best setups seemed to happen overnight and we never tested any new zones during the cash session. I am just not a fan of leaning on zones that have been tested multiple times as the more touches will lessen their strength.

TODAY’S PLAN:

Keep in mind we are still in a longer term down-trend, but the bulls and bears are just alternating turns behind the wheel. We have spent almost 3 months now just oscillating back and forth between this trading range we have built out between 70 and 82.50ish. One day the momentum seems to favor the bulls testing 82.50 for the FIFTH time and finally breaking it, then the next day the bears take over and look to make their push south for the 70 level again. Ranges like these are terrible for swing traders and breakout traders as the moves back and forth can cause frustration and losses trying to catch the next “big move”. But for day traders like myself they are a dream, as long as you are open minded to both sides and don’t let a bias get you on the wrong side of the trade and just play the rotations both up and down.

SHORT TERM (DAILY) BIAS - NEUTRAL - We are now One-Time-Framing up on the Daily Chart but the bears stepped in right where they needed to today. After watching today’s trade it is clear that 75 is going to be the LIS for the week as we saw how important it was for bulls. Daily 5-Day RSI is currently around 41.8 so basically neutral.

MID TERM (WEEKLY) BIAS - NEUTRAL - We are now One-Time-Framing down on the Weekly Chart after Wednesday’s trade took out last week’s low. We did get a bounce but we closed with almost a perfect doji candle on the weekly. Nobody is in control here.

LONG TERM (MONTHLY) BIAS - NEUTRAL - This is also still bearish, but keep in mind that January was an inside month compared to December, and we undercut January’s low by 20 ticks and immediately rocketed up. When you break out of an inside candle you want to see a strong continuation push and we got just the opposite. So the Bias is bearish by definition but if we take out January’s high (82.66) look to see if bulls step on the gas above that level or not. Ultimately we are still just in range and bouncing back and forth inside of it. When it breaks though, the energy built up is going to have a lot of force.

So to start off, I believe it is always important to come into each day without a bias. BUT, I do also believe that you need to “lean” a certain direction and have a PRIMARY plan that supports that lean. Then, just make sure if your plan doesn’t work out that you have a BACKUP plan that you can switch to and trade. Remember, this game isn’t about picking tops or bottoms or being right. It is about making money and trying to catch about half of each move so that you get the “meat” of it and can protect capital for the next trade. Crude Oil moves almost every day with a tradeable range and if you understand the moves and what it likes and doesn’t like to do you can capitalize on those rotations.

NEWS TO BE AWARE OF:

Canadian GDP - 830am EST

Chicago PMI Index - 945am EST

Consumer Confidence - 10am EST

BULLISH PLAN - So I am not really going to lean with either side at the moment. And that is because right now the PA is just really choppy and trappy, and I would be careful believing either side is in control until we are sure that they are. The bulls did hold 75 today (which they needed to do), but we were also trading near the lows until 6 minutes before the cash close. So I am not sure if that late day push was sellers taking profit after a pretty good day or new buyers stepping in for a leg higher. If bulls can get above 76 and HOLD above 76 then I think they will start working up the levels and have today’s HOD as their target. Above the high there will be some landmines and traps, but as long as they are above 76 I lean with them.

BEARISH PLAN - Bears had a decent day today. But that close was disappointing. They turned the bulls away all day and had a chance to put in a very bearish close, only to fumble in the final minutes of the day and give the bulls some hope. But we are coming into some pretty significant resistances overhead that could put an end to this bullish bounce. The area between 75 and 76 is absolute chop. If the bears get it under 75 and HOLD it down there then this bounce is over and the weekly low is in sight. Neither side has a real advantage right now but the bears do have some hope.

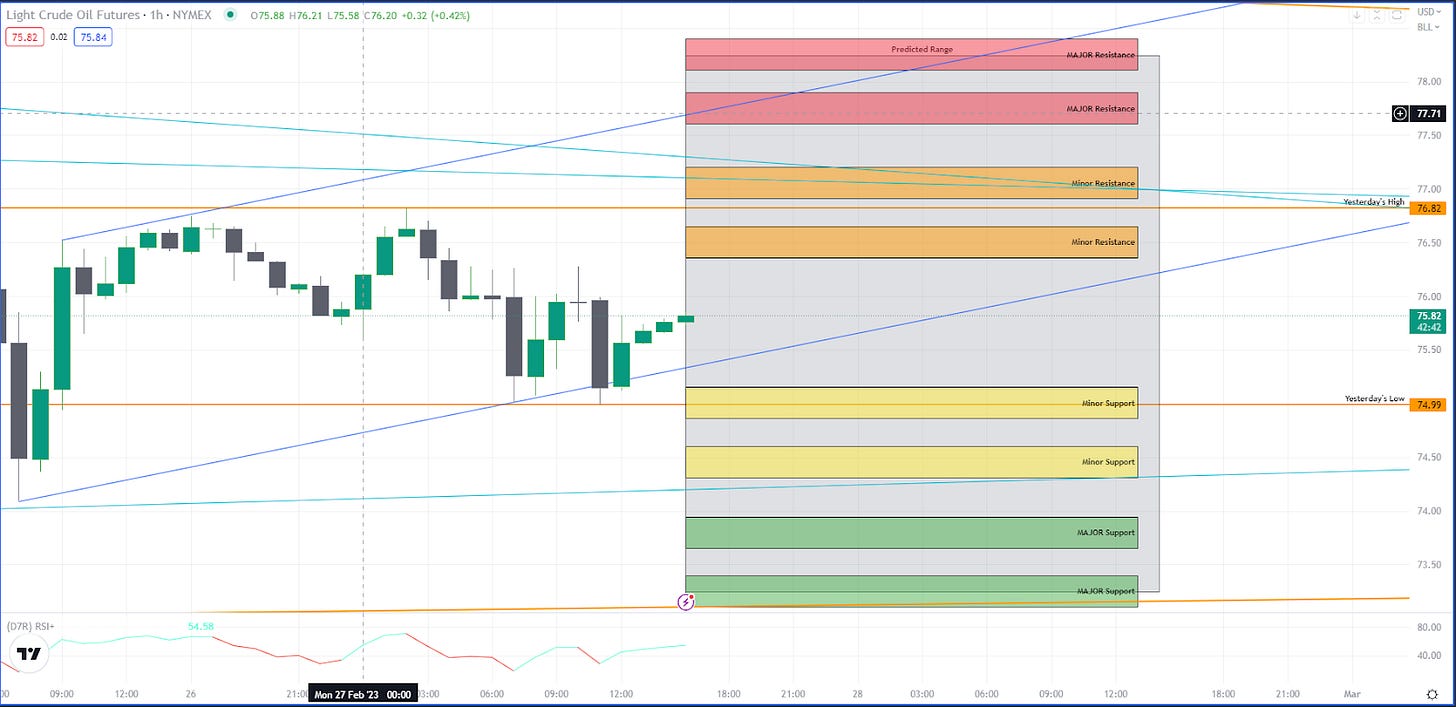

TUESDAY 2-28-2023 SUPPORTS/RESISTANCES

SUPPORTS:

75.15-74.85 (Minor) (Yellow)

74.60-74.30 (Minor) (Yellow)

73.95-73.65 (MAJOR) (Green)

73.40-73.10 (MAJOR) (Green)

RESISTANCES:

76.35-76.65 (Minor) (Orange)

76.90-77.20 (Minor) (Orange)

77.60-77.90 (MAJOR) (Red)

78.10-78.40 (MAJOR) (Red)

NOTES:

We are always trading the CL front month contract unless otherwise noted. As long as you enter the continuous contract in your TradingView it will update automatically for you. Right now that is CLJ23 (APR23 expiration).

The gray box on my chart is the “playing field” for the next session. I use a 30 day ATR (Average True Range) to get a feel for what the range of the session could be. I then take 75% of that amount and draw the box from the previous sessions CLOSING price. While it is entirely possible that we can trade outside this range, the days that happen are much fewer than the amount of days we trade inside of it all day. It is also possible that we open and go hard in only one direction and the entire range is to the upside or the downside. Just not probable. And in this business we need to be aware of and play the statistical probabilities and know when it is a good idea to expect reversion.

When I list the Support and Resistance “zones”... they are just that. ZONES. Crude is not something like ES that is easy to identify a price and nail it almost to the tick. Crude likes to make you sweat a little bit and question your entry as a hobby. I try to keep the zones to around 30-50 ticks since that is my normal stop loss size. But I also want to completely cover the actual level and leave some wiggle room. So if a zone is larger than 30 ticks you might consider starting small at the beginning of a zone and sizing in if we push deeper into it.

SUPPORTS and RESISTANCES - These are typically only for the upcoming session, but you may notice MAJOR ones could get carried for a while if they have gone untested. I have marked these on the chart above for a visual reference but I also find it handy to mark these on your own chart so that you are also aware of them when they break. I like to use Yellow and Green for Supports and Orange and Red for Resistance, but that is just my preference. Remember, a broken support can become resistance and vice versa. So if it is a day with a strong trend in one direction catching a retrace into a broken level could be a good entry to catch a resumption of the trend.

While I personally will try to knife catch and fade momentum at my MAJOR supports and resistances, I don’t recommend it for everybody. And if you do, I strongly suggest you use less size and be prepared to take an L if you step in front of a train. But I also know that if we are running up into a strong support, near the top of the range, and my short term indicators are screaming overbought that I have a great chance of catching a reversal and being able to take part of my position off at profit and holding some runners with a BE (breakeven) stop to see if it becomes something bigger. A Lot of times it comes back and stops me out. But I am willing to take those chances in certain spots.

DAILY RSI - I only mention the Daily RSI as a bit of a “mile-marker” for our short term outlook. RSI alone is never a reason to blindly short or long. BUT, used in conjunction with some good technical analysis it can be another point of confluence to help achieve an outcome. For instance, if the RSI is buried in the oversold region and we are approaching a MAJOR support, you can probably expect a decent FIRST TOUCH reaction out of that area. And the opposite is true for being way overbought coming into MAJOR resistance. Just remember it is a DAILY RSI reading and trying to use it to justify an intra-day trade with a tight stop might not be prudent. I find it works the best to identify times when the market needs to “cool off” and can often lead to flag patterns. I like to personally use a 5-Day DAILY RSI as an overbought or oversold reading as a sign we are extended in the short term.

STOPS! If you are going to commit to this game, you need to realize that you will not always be right. And you need to know when you are wrong. When I trade Crude Oil I use a 30-50 tick stop loss on a trade to manage my risk. But my overall pain threshold is based on a dollar amount loss on said trade. Because a lot of my support and resistance are “zones” I normally like to put on half size at the start of a zone with a 50 tick stop and then add the other half at the end of the zone and tighten the entire position to a 25-30 tick stop on my average. That way I can ease into full size and manage my risk. If I go full size all at once with a 50 tick stop I am probably sizing down due to volatility but the dollar amount at risk is always roughly the same as what I am currently trading. You should never need more than a 50 tick stop with CL because if you need more than that you are either wrong or you need to work on your entries.

RESTING LIMIT ORDERS - While a majority of the time I am supremely confident in my analysis and my levels, I never would recommend placing resting orders at them while you are sleeping. Crude Oil is a commodity that trades purely off supply and demand. And since a majority of the supply for the entire world comes from the other side of the world (if you are a US trader like myself) you will notice that market shaking news often comes out in the middle of the night. Nobody likes to wake up to see orders get triggered and levels get smashed by low volume rips in the middle of the night. We do 75% of the volume for the entire day during the Chicago CASH session. So that is the session that I would recommend most of you trade unless you live in Europe in which case the London session can definitely offer a lot of opportunities.

CHICAGO CASH SESSION - Since Crude is traded on the Chicago Mercantile Exchange, its “cash” session hours are from 9 est-230 est. The CL futures contract is still traded by the CME and does trade all the way until CME close at 4est. But the volume between 230-4est is very small and the low liquidity can make it hard to exit a position if you hold it past 230 est. So I normally recommend you be out completely by then.

OVER-TRADING - I personally only look to place a few trades every session. I am not scalping for 10 tick moves and will sit and watch all day for the perfect setup. Trades need to not only set up correctly in price but also TIME for me. It could reach my zone before the cash open or after the cash close and I might not take it because I am a day trader and want to be flat every open and every close. But I truly believe you can make a living on Crude Oil by stalking one potential setup, hitting it, and then letting the trade play out for a nice 50-100-200 tick gain.

EDUCATION ONLY - Last thing… This newsletter is not meant to be a signal service or tell you how to trade Crude Oil. This is basically me putting my own personal trading plan into words so that others can read and have a little insight into how I trade each session and want to trade the next. It is not my job nor my responsibility to push the buttons for you and so much more goes into trading than just knowing levels and pushing BUY/SELL… this is a game of longevity and you need to learn how to manage risk and also how to manage your emotions once you are in a trade. I can help with a bit of a roadmap or blueprint… but you still need to place the actual trade yourself.